There is a vast gulf between indoctrination and knowledge. The former is imposed by those who have power over you; the latter is sought and learned by questioning the propaganda of the powerful. You see, this world is comprised of those who are led and those who are force fed. We have a tendency to implicitly trust those with authority and accept what we are told automatically. I could cite an endless stream of examples where society kowtows to the “elites”; too many submit to a narrative or a “fact” not because it’s true but because someone in a position of authority says it’s so. Through repetition and brilliant marketing, outright lies and propaganda are digested by the broader public as biblical truths.

There is one particular narrative that I want to focus on today given how corporate media “journalists” are yet again celebrating the record highs on Wall Street. Bought and paid economists and compromised pundits love to eschew the virtues of investing in corporations and the benefits of being shareholders of Wall Street equities. A society enthralled with get rich quick schemes is bombarded with stories of people who got wealthy because they invested their money and rode the markets to pay dirt. The “go-to” line is always about how the markets, over the long haul, yield returns that exceed the rate of inflation and the returns one would get by saving their money. It seems like a no brain given this “truth; invest a percentage of your paycheck in Wall Street and you will have a nice nest egg waiting for you when you retire.

This is the reason why 401Ks and IRAs are all the rage these days. Corporations offer prospective employees discounts on their own shares and matching funds on mutual funds. A generation ago, workers—for the most part—were offered guaranteed pensions which gave employees the safety of a steady stream of income upon retirement. But some bean counter realized that pensions were overhead; a better option for corporations was to offload a fixed payment and unto the markets. 401Ks became a hit, not only were companies no longer on the hook for guaranteeing the retirement of workers, America would also become dependent on Wall Street.  It worked perfectly! We are now a nation held hostage by multinational corporations. We have been conditioned to accept that what is good for Wall Street is good for Main Street. In reality, what is good for Wall Street is actually lethal for all of us. This is because corporate capitalism thrives by squeezing money and resources from the public. Corporatism is the largest pyramid scheme in the world, it’s nothing short of grand theft as wealth is transferred from the masses in order to enrich the 1%. The oligarchy pulled off this feat by hijacking ever lever of government—we are a nation beholden to plutocrats.

It worked perfectly! We are now a nation held hostage by multinational corporations. We have been conditioned to accept that what is good for Wall Street is good for Main Street. In reality, what is good for Wall Street is actually lethal for all of us. This is because corporate capitalism thrives by squeezing money and resources from the public. Corporatism is the largest pyramid scheme in the world, it’s nothing short of grand theft as wealth is transferred from the masses in order to enrich the 1%. The oligarchy pulled off this feat by hijacking ever lever of government—we are a nation beholden to plutocrats.

This paradigm is made possible only because we as a people keep accepting half-truths as absolute facts. The benefits of 401Ks are a prime example of how we are programmed to believe bullshit and corporate propaganda. Technically, they are right. Over the long haul, the markets do yield positive returns. If someone invests a certain amount at the age of 21—if they properly diversify their portfolio and resist the temptation to withdraw their money—by the time they retire they will be in a greater position than if they put their money in a savings account or kept cash. If you accept this one sided corporate narrative, it would actually be wise to invest in Wall Street as much as possible.

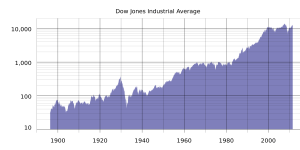

But what the corporate lackeys omit from their assessment is what happens when there is a crash like the Great Recession of 2008 or the dot com bubble implosion of 2001. The fact is that the US economy, and the broader global markets as a whole, are prone to retrenchment every seven to eight years. Corporate jargon calls this recurring downturn the business cycle, others who have noted this quirk refer to this periodic swoon as the Shemitah. The label doesn’t matter as much as the fact that the markets are susceptible to regular crashes; ever since the Great Depression of 1929, Wall Street has witnessed a cyclical recession every seven to eight years. See if you can spot the trend below.  Why is the business cycle and the recessions that return like clockwork germane to the issue of 401Ks and investing in Wall Street? I mean if people invest long term and ride out bear markets, it is proven that they will profit in the long haul. This is the corporate sermon that is preached like it’s the 67th book of the bible and blindly accepted by society. But what this narrative leaves out is what happens when recessions arrive. It’s easy for those living high on the hog to preach patience to the rest of us, but what if you are faced with dire straights? What if you lose your job or your business bites the bullet? What if you are facing a foreclosure or evictions during a market crash?

Why is the business cycle and the recessions that return like clockwork germane to the issue of 401Ks and investing in Wall Street? I mean if people invest long term and ride out bear markets, it is proven that they will profit in the long haul. This is the corporate sermon that is preached like it’s the 67th book of the bible and blindly accepted by society. But what this narrative leaves out is what happens when recessions arrive. It’s easy for those living high on the hog to preach patience to the rest of us, but what if you are faced with dire straights? What if you lose your job or your business bites the bullet? What if you are facing a foreclosure or evictions during a market crash?

When recessions arrive, people are faced with a Sophie’s choice of sorts. Cash out their 401Ks and risk long term insolvency or keep money in the markets and face immediate threats of homelessness and indigence. The minute people decide to cash out and access money from their 401Ks, they are screwed royally. People who turn to their “retirement savings” out of desperation are put into the grave of poverty by regressive taxes that punishes early withdraws with penalties and fees. This is malice perfected as government and corporations work hand in hand to reward themselves as they bludgeon the rest of us.

Once people are forced to cash out their 401Ks or IRAs and are unfortunate enough to become impoverished, they rarely regain the shares they once owned. This is where the corporate narrative of long term profits falls apart and is exposed as the bunk that it is. Theory has a way of falling apart when it’s blown apart by reality. The only people who are guaranteed long term profits are those who are wealthy enough to endure recessions and have the wherewithal to withstand the pressure of having to liquidate their positions in order to remain financially viable.

Have you noticed how the population of homeless people seem to be exploding these days? Go talk to one of them for a few minutes—trust me, some of the kindest people you will ever meet are the ones society often ignores. Chances are the first person you talk to became homeless after the Great Recession of 2008. Our economy is tearing apart lives and shredding the middle class—this is the truth corporate journalists never mention as they cheer lead Wall Street and rave about markets closing at their highs. Let me give you a little warning, take this from a friendly stranger, markets closing at record highs day after day is not a good sign, this is omen of another “market correction’ (implosion) lurking in the near future. Only fools rush into inflated markets; the wise money always bolts for the doors when Wall Street is celebrating record highs.

Beyond the grand larceny that Wall Street is engaging in as they rob us blindly by way of politics and policies, there is another more insidious aspect to their shenanigans. 401Ks and IRAs have become double-barrel shotguns to our heads. Think back to 2008; when banks like Goldman Sachs, JP Morgan Chase and Lehman Brothers gambled with our life savings and crashed our economy, they used the threat of our life savings going down with them in order to coerce us to finance their bailouts. Their reward for committing the largest theft in the history of humanity was to get trillions for them and for millions of their victims to become homeless.

For the record, I am not anti-business nor am I espousing communism. I’m actually a thousand times more pro-business than the leeches on Wall Street. I love entrepreneurship and encourage people all the time to go into business for themselves. We all have unique gifts, we should do as much as we can to pursue our dreams instead of to fulfill the dreams of others. This is the reason I am against corporations; not only does corporatism encourage institutional greed and societal gluttony, corporations also make it their purpose to eradicate marketplaces in order to monopolize market share. Corporations are the cancers of this earth; they use their size and scale to kill off competition and turn all of us into slaves of their agenda. Wars, genocides, climate change, scarcity that leads to famines and death and beyond—most of these iniquities can be traced back to the blight of corporatism. Wall Street and their ilk are a clear and present threat to humanity and our planet.  Too big to fail is still with us; Wall Street is still gambling with our life savings and the world economy irrespective of the lies peddled by corporate media (read Dodd-Frank Shakedown). This is what happens when we give our hand to concentrated power and allow ourselves to be ruled by federalized enforcers who govern without consent. As long as we acquiesce to the powerful and submit to the will of plutocrats, we will keep getting exactly the government we deserve. Maybe we should stop believing people who have a financial motive to lie to us. Or else the homeless person you talk to after the next recession hits will be the person in the mirror. #401KOed

Too big to fail is still with us; Wall Street is still gambling with our life savings and the world economy irrespective of the lies peddled by corporate media (read Dodd-Frank Shakedown). This is what happens when we give our hand to concentrated power and allow ourselves to be ruled by federalized enforcers who govern without consent. As long as we acquiesce to the powerful and submit to the will of plutocrats, we will keep getting exactly the government we deserve. Maybe we should stop believing people who have a financial motive to lie to us. Or else the homeless person you talk to after the next recession hits will be the person in the mirror. #401KOed

“Lust and greed are more gullible than innocence.” ~ Mason Cooley

Check out the Ghion Cast where I discussed the very topic of corporatism and how concentrated power in the hands of a few is impoverishing our nation and killing our planet.

Teodrose Fikremariam

Latest posts by Teodrose Fikremariam (see all)

- A Reflection in a Time of Turmoil - June 4, 2020

- Ethiopia’s Choice: Poverty through Grievance or Prosperity through Unity - September 9, 2019

- Bloody 60s: the Decade that Aborted Leadership in America - August 22, 2019